Turning the traditional CRE planning process upside-down to anticipate changes in business.

As strategists and designers of interior environments, there are many factors to juggle on each project at any given time. Yet space is a resource just like people, and money and Real Estate and Facilities (RE&F) teams can develop skills currently leveraged by technology, political science, and economics to keep up with future Corporate Real Estate (CRE) demands. However, even the best team may not be able to fully realize its potential with a traditional CRE structure and process and may look to innovative systems outside our industry that can respond to any level of change.

Innovation consultancy Doblin outlines a framework for innovation on the premise that the odds of success increase exponentially if innovation is built up systematically. To re-design the traditional CRE system, we must check multiple boxes. Changing the process for our industry must start with Configuration, and for success we set up the Offering (the product or service) and the Experience.

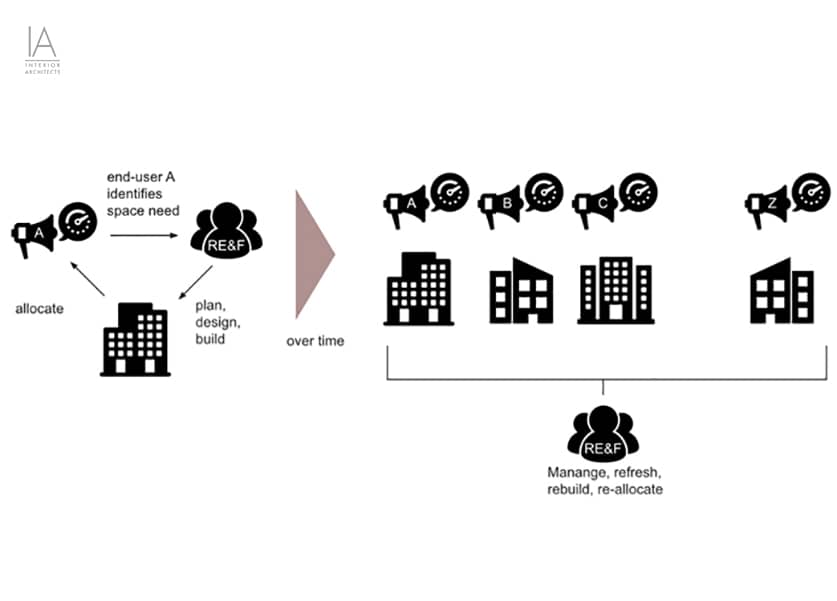

In a traditional CRE process, RE&F accumulates a portfolio of space that continuously evolves to meet new demands from the end-user, and can be refreshed/re-built/re-allocated on demand. Stakeholders know this process of matching supply with demand can take months, if not years, due to a variety of long lead-time steps including legal, approvals, planning, design, build, and the politics of moving teams.

While this is a frugal model, the increasing fast-changing nature of business means that the gap between business demand and CRE’s ability to respond is widening. At best, this model leads to spaces that may work for the business, since information asymmetry will always exist at some level. At its worst, a business is not able to move forward because it doesn’t have the space to be productive.

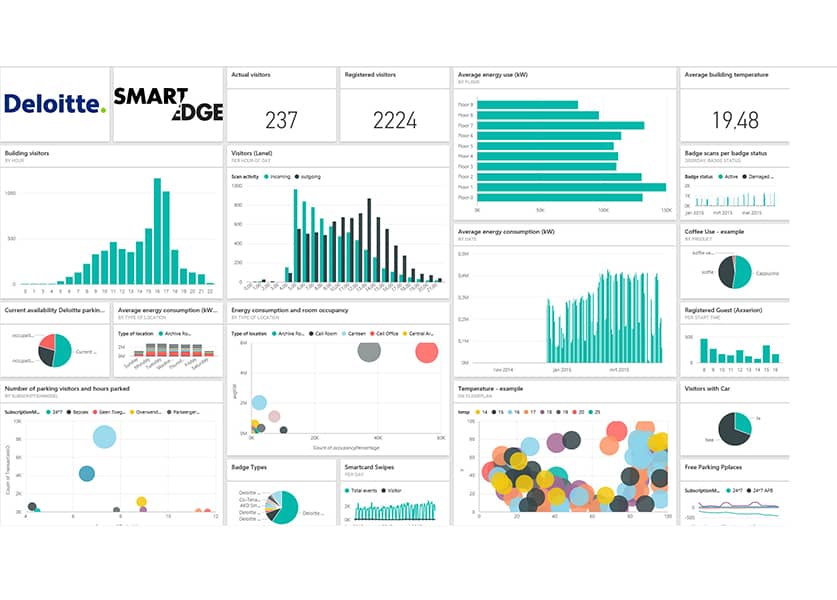

A more efficient model can be structured around free-market principles. This model already exists but is primarily implemented on either a very small or very large scale. On the smallest scale for activity-based work spaces, end-users seek out and self-select a space, similar to purchasing a house—minus the cost consideration. RE&F can predict the demand through big data analysis of space usage and adjust the space type mix to meet demand, for example, build more phone rooms, provide more conference rooms, etc., similar to Deloitte’s Edge in Amsterdam. On a larger scale, commercial real estate is driven by market demands, as well as what developers predict the market will need.

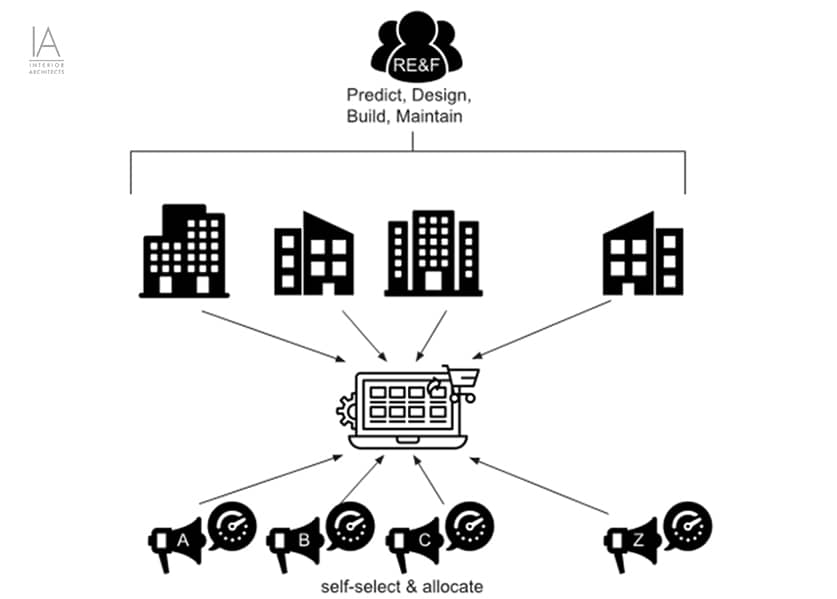

CRE can implement a model where business leaders perform a targeted search to self-select and self-allocate without a lot of intervention from RE&F, since they know their team’s needs best. RE&F’s role in this model is to focus on predicting the right type and amount of spaces, taking into consideration the varying complexities of labs/critical environments, offices, and amenities, and designing those well and providing guidance to help business groups find space and define process.

Implementation of this model is not without its challenges. Which level of the business gets to shop for space is one of the primary decisions. Managers may not know the overall corporate strategy, while an executive vice president may not know the working details of a team. However, with a diversified portfolio, feedback mechanism, and governance protocols, this model could yield a more resilient business with higher user satisfaction and less cost over time.